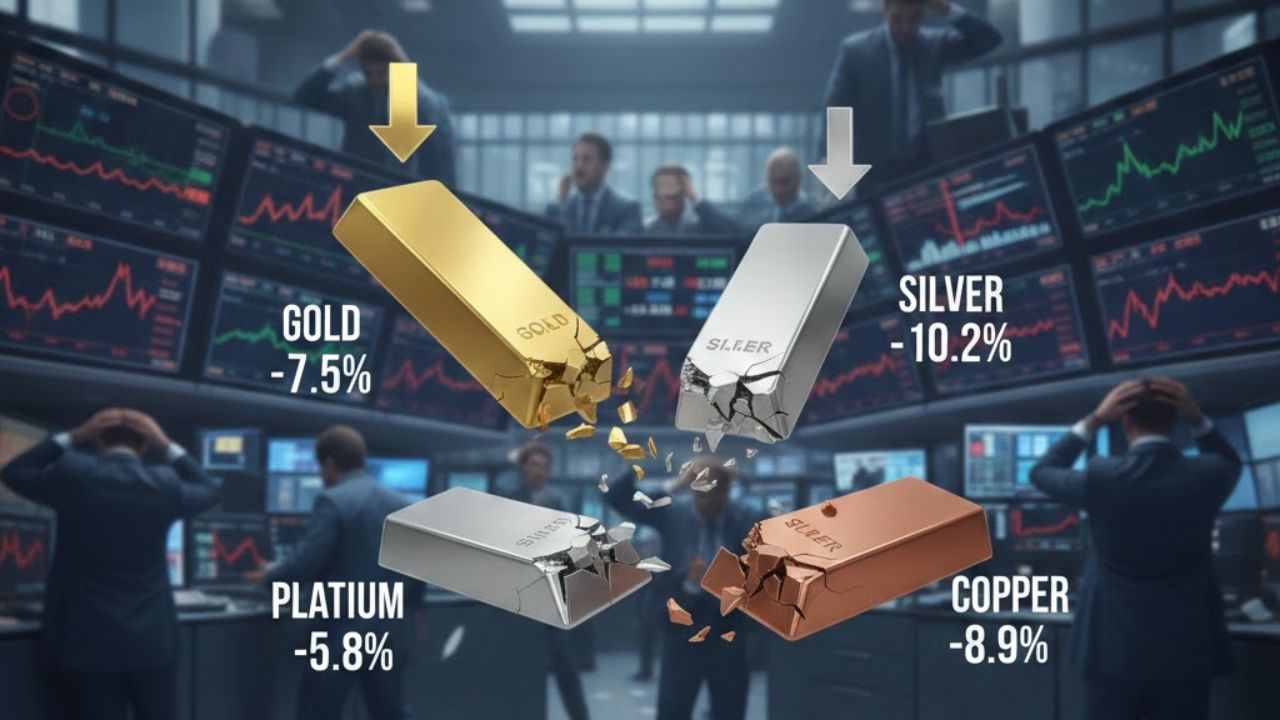

The global metals market witnessed a period of intense turbulence on February 13, 2026, as a wave of volatility swept through both precious and industrial commodities. Investors who had become accustomed to the steady climbs of 2025 were met with a sharp reality check as gold, silver, platinum, and copper all experienced significant price fluctuations. This “market chaos” was triggered by a perfect storm of macroeconomic data, shifting central bank expectations, and a sudden unwinding of leveraged positions. The primary catalyst appears to be the release of stronger-than-anticipated U.S. labor market data, which has forced a massive reassessment of the Federal Reserve’s interest rate trajectory for the remainder of the year.

The Gold and Silver “Flash Crash” Dynamics

Gold and silver, often considered the dual pillars of the precious metals world, bore the brunt of the initial selling pressure. Spot gold prices, which had been flirting with historic highs, tumbled by over 2% in a single session, testing critical support levels near $4,980 per ounce. Silver’s descent was even more dramatic, plunging nearly 9% to hover around $76.53. This rapid decline resembled a “flash crash” in the futures markets, likely exacerbated by automated trading algorithms and the triggering of stop-loss orders. The surge in the US Dollar Index (DXY) to the 97 mark made these dollar-denominated assets significantly more expensive for international buyers, further dampening global demand.

Industrial Metals and the Copper Conundrum

While gold and silver reacted to monetary signals, copper and platinum faced their own set of challenges. Copper, the “barometer of global economic health,” saw its price dip to approximately $5.83 per pound. The industrial metal is currently caught in a tug-of-war between supply deficits and fears of a manufacturing slowdown in major economies. In China, refined copper output is projected to rise by 5%, yet a reported surplus in the global market has made investors cautious. Platinum also faced a downward trend, dropping to $2,022 per ounce, influenced by a broader retreat in the PGM (Platinum Group Metals) sector and shifting industrial requirements in the automotive industry.

| Metal | Spot Price (Approx.) | Daily Change (%) | Market Sentiment |

| Gold | $4,975.39 /oz | -1.09% | Bearish / Consolidating |

| Silver | $76.76 /oz | -2.13% | High Volatility |

| Platinum | $2,022.40 /oz | -0.03% | Stable / Weak |

| Copper | $5.83 /lb | -0.77% | Cautious |

Why Prices Are Crashing: The Federal Reserve Factor

The sudden shift in market sentiment is rooted in the “higher for longer” interest rate narrative. Recent nonfarm payroll data showed the US economy adding 130,000 jobs—nearly double the forecast—while the unemployment rate dipped to 4.3%. For the metals market, this is bad news. A strong labor market suggests that inflation may remain sticky, giving the Federal Reserve less incentive to cut interest rates. Higher interest rates increase the opportunity cost of holding non-yielding assets like gold and silver. Consequently, the probability of a March rate cut has plummeted from 20% to a mere 8%, causing a massive exit from “long” positions in the bullion market.

Domestic Impacts: Gold and Silver Rates in India

The international chaos quickly localized in major hubs like India, where MCX (Multi Commodity Exchange) rates reflected the global softening trend. In cities like Hyderabad, Mumbai, and Delhi, 24K gold prices slipped marginally to stay around ₹14,631 per gram. Silver saw even more erratic behavior on the domestic front, oscillating between ₹2.80 lakh and ₹3 lakh per kg. Local exchanges have responded to this volatility by hiking margin requirements—up to 7% for silver—in an effort to curb speculative trading. This move has sidelined many retail investors, leading to a “wait and watch” approach as the market attempts to find a new floor.

Technical Outlook: Support and Resistance Levels

From a technical perspective, the metals are currently testing “make-or-break” levels. Analysts suggest that for gold, the $4,900 mark is the primary line of defense; a break below this could signal a deeper correction toward $4,700. Silver is currently finding some footing near the $74-$76 band, but the gold-to-silver ratio has widened to 61:1, indicating that silver is underperforming its yellow counterpart. For copper, the 50-day exponential moving average (DEMA) remains a crucial support. If these levels hold, the current “chaos” might just be a healthy correction in a long-term bull market; if they fail, the correction could turn into a prolonged bear phase.

Strategic Considerations for Investors

Navigating a volatile market requires a shift from speculation to strategic allocation. Many market experts are now advocating for “value buying” at these lower support levels, under the belief that the fundamental drivers—geopolitical tensions and long-term supply deficits—remain intact. However, the immediate future is clouded by upcoming US inflation data (CPI and PPI) scheduled for release later this week. Until there is more clarity on the Federal Reserve’s next move, the metals market is likely to remain a playground for high-frequency traders, leaving long-term investors to look for signs of price stabilization before re-entering the fray.

FAQs

Q1. Why did silver prices drop more than gold today?

Silver is both a precious and an industrial metal, making it more sensitive to economic shifts. Additionally, silver markets are less liquid than gold, which often leads to sharper, more volatile price swings during market sell-offs.

Q2. Is this the end of the bull run for precious metals?

Not necessarily. Most analysts view the current volatility as a technical correction driven by strong US economic data. The long-term outlook remains supported by geopolitical uncertainty and a physical supply deficit in the silver market.

Q3. How do higher interest rates affect copper prices?

Higher interest rates typically strengthen the US dollar and can slow down industrial activity by making borrowing more expensive. Since copper is used extensively in construction and manufacturing, higher rates can dampen demand and lower prices.

Disclaimer

The content is intended for informational purposes only. you can check the officially sources our aim is to provide accurate information to all users